Amazon FBA Sales Tax 2020: A Comprehensive Guide For FBA Sellers

Have you ever wondered what would happen to your Amazon FBA business if you fail to collect sales tax correctly? What States do you even have to collect sales tax in? Could you be at risk of being audited and forced to pay uncollected sales tax out of your own pocket?

The topic of Amazon FBA sales tax can be overwhelming and scary, especially for beginners. The answers are by no means as simple as some websites and service providers are making it out to be.

There are a lot of incomplete, yet conclusive sounding answers out there. When in reality the laws regarding FBA sales tax are just not crystal clear right now.

Not only do you get different answers from each source, but even answers from tax service providers should be taken with a grain of salt. After all, they have an underlying agenda of selling you their tax services.

To get you the best information on FBA taxes, I interviewed Paul Rafelson, a tax attorney who holds a master of tax law (LLM) and is a professor at Pace Law School teaching constitutional law on state and local taxation. Paul is also a former tax counsel for some of the world's largest companies such as Microsoft, GE, and Walmart.

Over the last few years, Paul has been leading the charge in the sales tax legal battle on behalf of online merchants and FBA sellers just like you. He is fighting to protect the entire merchant community from states like California, who are pursuing sellers for up to 8 years of back taxes.

As executive director of Online Merchants Guild (OMG), Paul wrote and submitted an amicus brief to the Supreme Court, bringing the FBA sellers perspective to the case over online sales taxes. More on why this case matters to your FBA business.

If you are an FBA Seller and you think you know about nexus and the physical presence rule, or the potential implications it might have on you and your business, you should think again.

"You most likely learned about it from your tax service provider, who is trying to sell you their services on a perpetual basis - potentially leaving out a lot of relevant information."

So clear your mind and pretend you are learning about FBA sales tax for the first time. With help from Paul, we'll start with the basics and cover the entire topic of Amazon FBA sales tax from A-Z.

We'll cover:

- The Basics of Sales Tax

- When Are You Required to Collect Sales Tax?

- FBA Sellers & Nexus

- History Of Physical Presence & Nexus

- Where The Law Stands Today

- Amazon & Sales Tax

- Cost of Tax Compliance for FBA Sellers

- Sales Tax Amnesty Program

- When To Collect Sales Tax

- How To Collect Sales Tax

Please note: THIS GUIDE IS FOR INFORMATIONAL PURPOSES ONLY & SHOULD NOT BE CONSTRUED AS TAX OR LEGAL ADVICE.

The U.S. system of government has a central (Federal) government and the States, which function as the basic unit of political power and have their own sovereign set of powers.

When it comes to taxes, the federal government taxes you at the federal level and then the states get to decide what they want to tax on top of that. The U.S. has separate federal, state, and local taxing jurisdictions, guided by the U.S. Constitution and controlled at each of these levels by the respective authorities.

Sales tax is defined as a tax on the sale, transfer, or exchange of a taxable item or service. Conventionally, sales tax is collected by the retailer and passed on to the respective states taxing body.

In most states, although the buyer is technically responsible for sales tax, ultimately it's the retailer's job to properly collect and remit the taxes to the states. If a retailer fails to do so, the states can hold them responsible - potentially paying out of pocket.

Washington D.C. along with 45 of the 50 U.S states, all have sales tax in their jurisdiction. Most of these states also allow local areas such as cities and counties to have their own sales tax.

Each state has the power to create and administer taxes as they see fit. This means all of the 50 states have different processes and laws when it comes to sales tax.

For example, below is the breakdown of sales tax in New York state for the given jurisdictions:

| Items | Rates |

|---|---|

| New York State Sales Tax Rate | 4% |

| Dutchess County Rate | 3.75% |

| Rhinebeck City Rate | 0% |

| Metro Commuter Transportation District Tax Rate | 0.37% |

| Total Sales Tax Rate | 8.125% |

Source: FBAMap.com

Not only is the tax rate different in each state, but each county within the state could also have their own tax rates and rules. Imagine having to file as many tax returns as Walmart & Microsoft for your small FBA business.

States and these local jurisdictions use this tax money for their budget items like public schools, transportation services, and public safety initiatives. They have complete say and authority over what they want to tax and at what rate under the law. Unlike a business, a major portion of the state's revenue comes from sales tax, so rest assured, if you owe them, they will come to collect!

How Do I Know When I Am Required To Collect Sales Tax?

In the United States, a tax is required on all taxable goods and services. As a business, you are required to collect and remit this sales tax if you have 'NEXUS' with a given state. So what exactly is nexus?

NEXUS

Although there is no specific shared definition across the 50 states, under the U.S. Constitution, nexus is the concept stating; you have to have a certain presence in a state, in order for the state to assert its jurisdiction over you.

Sales tax nexus is essentially defined by the level of connection between a taxing jurisdiction (state) and an entity such as your Amazon FBA business. Unless this connection is established, by law, the taxing jurisdiction cannot impose its sales tax over you.

The majority of people often associate nexus with just being just about physical presence, however, that is not always the case. There are actually TWO types of nexus; one under the Due Process Clause and nexus under the Commerce Clause.

- Nexus under the Commerce Clause: As interpreted by the Supreme Court, the Commerce Clause "prohibits states from enacting laws that might unduly burden or inhibit the free flow of commerce between states." Essentially the taxpayer must have "substantial nexus" or physical presence with the state, in order for the state to impose its tax rules on you.

- Nexus under the Due Process Clause: The Due Process Clause prohibits states from taxing a 'corporation' unless there is "minimal connection" between the company and the state in which it operates. The due process clause essentially says that states can not "deprive any person of life, liberty, or property, without due process of the law." So unless FBA sellers meet this threshold, they would not have to abide by the respective state's tax laws.

Due Process nexus is the basic notion of, can you be sued in a state? It has nothing to do with tax. Taxes are just one of the many things that you would not be subject to; if you did not have nexus under the Due Process Clause.

For example, as an FBA seller, if you ship your products to the Amazon warehouse as directed by Amazon, all you would do is print the label and ship it in. Let's say the label directed you to ship the respective products to a warehouse in New Jersey.

If Amazon decides to take those products from New Jersey and ship them to their warehouses in California, California now thinks you have nexus in their state - by way of inventory presence. When in reality, you didn't put those products in California, AMAZON did!

According to Paul, this raises a lot of questions under the Due Process Clause. Because you did not directly have any activity with California in the above scenario, you don't have the "minimal connection" required for a state to impose its jurisdiction over you.

From the state's perspective, considering your FBA inventory as triggering nexus, must mean they view FBA sellers as having physical presences nexus under the Commerce Clause. This could potentially mean you have nexus in each state with an Amazon fulfillment center.

So what does this mean for Amazon FBA sellers?

This is where the debate on FBA Sales tax gets a little more complicated and differs depending on who you talk to. Tax Service providers might tell you to register in (X) amount of states so you can use their services. But what they often fail to mention, is what exactly comes with registering with a given state? Can your business afford the cost of compliance?

As previously mentioned, there are over 10,000 different taxing jurisdictions, all with different processes and rules; making it extremely complex and costly to comply with each of these jurisdictions. As an FBA seller, you simply don't have the resources to do this.

At a fundamental level, we know that a business or entity, by law, must collect and remit sales tax in any state, where they create nexus.

So the question then is, as an FBA seller where do you trigger nexus? If so, do you have 'physical presence' or a 'minimal connection' required under the Due Process Clause for that state to subject you to their tax laws?

As we noted, if the answer is yes, then you are required to collect and remit sales tax. However, the answer, in reality, is far from clear-cut when it comes to FBA sellers.

FBA Sellers and Nexus

As an FBA Seller, although the definition differs across each state, the commonly held view is that, if you have inventory in an Amazon Fulfilment Center, chances are you have nexus with that state. Also because each states' sales tax laws are different, what determines nexus in each state also varies.

As a general rule of thumb, FBA sellers are often advised to consider collecting sales tax, if the following conditions are met:

- Having "substantial nexus" in the respective state

- What you sell is subject to sales tax in the state

- The amount of tax would be "material" to your business

Another important question at the heart of the debate over FBA sales tax and nexus, is whether using the FBA program to sell on Amazon's Marketplace, is even sufficient enough to trigger nexus for FBA Sellers.

Does having your inventory in Amazon's warehouse make you a supplier or a retailer under the law? Are online merchants responsible for sales tax liability, even in states where they don't have stores, warehouses or even interface with the customers?

Paul's answers and approach to these questions differ from the commonly held view. Although debatable, his main point of focus is not on whether selling through FBA creates a sales tax liability in most states - which it does, but rather, who's tax liability it is?

In his view, the key question in this debate is not about the physical presence of FBA sellers or even nexus for that matter, but rather who is the retailer in this relationship?

For example, let's take a hypothetical scenario and look at Starbucks and Costco to illustrate this point.

Let's say both Starbucks and Costco have nexus in a given state. If you go and buy a bag of Starbucks coffee inside a Starbucks store, then Starbucks is responsible for collecting sales tax on that bag of coffee.

However, if you were to buy the bag of Starbucks coffee inside of a Costco store, Costco is responsible for collecting sales tax on that bag of coffee.

There is no agreement that Costco and Starbucks can execute, that would ever allow Costco to avoid its responsibility (as the retailer) of collecting sales tax on bags of Starbucks coffee sold in Costco stores.

Paul argues the underlying fundamental relationship between third-party sellers and Amazon FBA is the same as Starbucks and Costco. No state would allow Costco, to one day decide they are now the "Costco marketplace" and not collect sales tax on products sold in their stores.

Sales tax is a "pass-through tax" and should never come out of the retailer's pockets - unless you fail to do it right. It is called pass-through for a reason; the retailer collects it and passes it onto the state.

In Paul's view, by simply defining themselves as a marketplace, Amazon, as a result, is unduly putting the burden of collecting sales tax on FBA sellers. Amazon does everything a retailer does, from collecting money to interfacing with the customers but somehow avoids the tax liability.

Amazon is also not like an open-marketplace such as Craigslist, they control EVERYTHING - from the data to money. Technically they collect taxes and hold it for two weeks before the 3rd-party seller can even access it.

So why are FBA seller being burdened with the responsibility of sales tax, when Amazon will always play the retailer role in its relationship with 3rd party sellers? The short answer is a little political, more on this later.

To understand today's landscape regarding sales tax, we have to look back at how we got here.

How did we get here?

The topic of sales tax has been a hot issue amongst online sellers, primarily because of the decision in the South Dakota V. Wayfair case; ruled on by the Supreme court in June of 2018. The decision overturned the longstanding precedent regarding nexus and physical presence dating back to 1967.

Most FBA sellers likely learned about sales tax and physical presence from their tax service providers.

This means they often leave out a lot of relevant information and at times make conclusive statements about the law when they are not lawyers. Before you make a tax decision, it 's imperative you understand why, and what comes along with that decision.

Before we look at the big picture implications and current landscape - that results directly from the Wayfair case, let's take a look at how we got to the Wayfair decision.

History of Physical Presence and Nexus Law

The laws regarding nexus and physical presence stem from a Supreme Court decision over 50 years ago. In 1967, in a ruling between National Bellas Hess V. Illinois Department of Revenue, the Supreme Court ruled that the Due Process and Commerce Clause of the U.S. Constitution prevented states from requiring 'remote' retailers - with no physical presence in a state - to collect and remit sales tax.

This ruling essentially said that states can't impose their tax rules, even if one has due process nexus - unless you have some kind of physical presence in the state.

The issue of nexus and physical presence came up again in 1992, in a court case Quill V. North Dakota. The states were trying to reverse the 1967 decision regarding physical presence.

However, the courts upheld the 1967 decision in order to protect the catalog mail-order industry. They once again reaffirmed that retailers must have some kind of presence in a state before a state can require the retailer to collect sales tax.

In 1992 when the case over physical presence was ruled on, we did not have Amazon or e-commerce. E-commerce since its inceptions has gone on to disrupt business as we know it.

You can now, from your living room, sell to customers across the globe with just a few clicks. This disruption and consequent decrease in the barrier to entry, is forcing us to redefine what it means to have a physical presence.

Source: Statista.com

When the courts decided the Quill decision, the mail-order industry sales in the U.S. totaled $180 billion, by 2008, e-commerce sales alone totaled $3.16 trillion. As you can imagine, this is a major pain-point for the States - who rely on tax revenue for their budgets - but are not constitutionally able to force 'remote' merchants to collect sales tax.

Why was the Quill case so important?

The supreme court ruling in Quil was significant for many reasons. Before the Wayfair case Despite the over $3.16 trillion in economic activity, the states, on principal could not force merchants with no physical presence, to be held responsible for sales tax - even if they have due process consideration in that state.

This can put the seller in a real dilemma. Do you fight the States on the constitutional principle? Or go along with the States statue, because you don't have the resources to fight them?

In 2015, the supreme court took the position, that the 1992 decision "badly went astray." They noted that the Quill case now "harms the states to a degree far greater than could have been anticipated in 1992." The internet has caused systemic and structural changes in the economy and therefore, the case regarding physical presence should be revisited and ruled on to reflect today's realities.

For these and other reasons, the Supreme court invited the States to bring forth a case, so they can rule on the issue of 'physical presence' being required, for there to be a sales tax nexus.

This brought us to the Wayfair case in 2018, and the confusing sales tax landscape we see today as a result.

In South Dakota v. Wayfair, South Dakota changed its sales tax law to include an economic nexus threshold. The new law essentially said that nexus is triggered by "at least 200 sales or $100,000 in South Dakota sales revenue within a calendar year." Wayfair - a multi-billion dollar company - of course, met this threshold.

Wayfair challenged the constitutionality of South Dakota's nexus rule and won at the South Dakota Supreme Court level. Because of the decision in the 1992 Quill case, states still could not constitutionally force retailers to collect sales tax without physical presence. This set the stage for the U.S. Supreme Court to finally review and rule on the physical presence rule.

For the first time in 25 years, we were finally going to get answers on where we go from here regarding physical presence - or so we thought. "What we got from the Supreme Court decision in South Dakota V. Wayfair case is actually not as clear-cut as others are saying."

Where Does The Nexus Law Stand Today?

In the South Dakota V. Wayfair case, the Supreme Court overturned the precedent set by Quill - saying that retailers must have a presence in a state before the state can impose its sales tax jurisdiction. According to the Court, "the physical presence rule in Quill is unsound and incorrect."

Their argument broadly was that "modern e-commerce does not align with the sort of physical presence defined in Quill." Therefore, they concluded that "business does not need to have a physical presence in a state to satisfy the demand of due process."

This now means, not only can physical presence trigger nexus, but an economic presence in states can also create sales tax nexus. In other words, after the Wayfair ruling, even if you don't have a physical presence in a state, but you meet an economic threshold, you can legally be obligated to collect and remit sales tax to that state.

For example, let's take a look at the threshold in the states of Michigan and Washington, that triggers economic nexus for remote sellers post-Wayfair.

| State | Sales Threshold | Transaction Threshold | Effective Date |

|---|---|---|---|

| Michigan | $ 100,000 | 200 | September 30, 2018 |

| Washington | $ 100,000 | 200 | October 1, 2018 |

Source: Taxjar.com

Paul's view on this court decision is different than the common narrative on the issue. He argues that the Court's decision has to do primarily with entities like Wayfair and does not apply to small businesses or merchants such as FBA sellers.

Although the Supreme Court overruled the physical presence rule, forcing small businesses to comply with the thousands of taxing jurisdictions across the nation would "place an impossible and unnecessary burden" on those businesses. He points to case laws that constitutionally support this position in his Supreme Court brief.

The Supreme Court's argument, he points out, was about, how can a multi-billion dollar company such as Wayfair, claims "it is a burden" to collect sales tax; when many other big companies such as Walmart are collecting. In reality, Wayfair was doing so to keep their competitive advantage.

This is the same reason Amazon is avoiding to collect sales taxes and pushing the burden on to 3rd party sellers. Competitive advantage in the business world, especially at the scale of these companies, is a big deal."For example, when Jet.com started collecting sales tax, because they thought they had to, their sales dropped about 8% - 9%."

Amazon's total revenue for 2017 was $178 billion, an 8% drop in sales would cost them over $14 billion in sales per year. This might give you an idea of why Amazon won't just 'bite the bullet' and start collecting sales tax, on behalf of FBA sellers voluntarily.

According to Paul, "This fight at a constitutional level is by no means over. The Courts made it very clear that this 200 transaction test is challengable by a smaller business." This is exactly what Paul and the Online Merchants Guild are currently working on. From the perspective of the small seller, he believes that the new law is actually unconstitutional. As an FBA seller, Paul's fight in this case directly affects you and the future of your business.

" Requiring small businesses or online merchants to collect and remit sales tax", in the roughly 10,000+ different jurisdictions - a 6-figure compliance cost, "places an undue burden on interstate commerce, and is therefore unconstitutional."

Amazon And Sales Taxes

So why aren't the states coming after Amazon for FBA sales tax? After all, Amazon is essentially synonymous with e-commerce; with over 50% of the online retail market and valued at a $1 trillion in 2018. If anybody can afford to take on the sales tax collection obligations, it's obviously Amazon, not the small and medium-size FBA sellers.

The sales tax debate is nothing new to Amazon. In fact, Amazon was created in 1995 - three years after the Quill decision, on a business model that is designed to avoid sales tax. Jeff Bezos is upfront about this - in an interview, avoiding sales taxes drove the company's decision to locate in Seattle. "It had to be a small state. In the mail-order business, you have to charge sales tax to customers who live in any state where you have a business presence."

At the time only those retailers with a physical presence in a state, paid sales taxes, so a home state with a small population meant the lowest possible sales tax burden. This the same reason Amazon's first fulfillment centers were located in states with small populations.

As Amazon grew, they maintained their strategy of tax avoidance, by ensuring their activities could not be construed as establishing "nexus" (a physical presence in a state). Amazon's playbook for 20 years has been to avoid taxes and deflect the burden. But as their growth required more warehouses in more states, by 2010 they were operating in 17 states.

Despite making the avoidance of sales tax collection a central part of their growth strategy, as of April 1, 2017, Amazon now collects sales taxes in each of the 45 states that have sales tax.

Source: itep.org

but there is a loophole that Amazon takes advantage of. It does not collect state sales tax on purchases made from third-party FBA sellers, which make up more than half of all purchases on Amazon. This can leave small FBA sellers extremely vulnerable to the states.

The states are not bound by anything in the contract between FBA sellers and Amazon Marketplace. They can come in an assert whatever they want in regards to taxation and more often than not, the smaller guy is easier to go after.

To fully grasp the role Amazon plays in this debate, will require us to first examine a few important factors.

Is Amazon a retailer or a marketplace?

What most people often fail to realize is the difference between Amazon.com, Inc and Amazon Marketplace. It's helpful to view these entities in two separate buckets. Amazon Marketplace is the e-commerce platform owned and operated by Amazon.com, Inc. Therefore, Amazon is both a retailer and a marketplace.

They collect taxes on all products sold in the marketplace by 'Amazon's retail arm', as they have to abide by ' online retailer laws' for those sales. However, when it comes to their Marketplace, they are guided by Marketplace Facilitator legislation.

"A marketplace facilitator is defined as a marketplace that contracts with third-party sellers to promote their sale of a property, digital goods, and services through the marketplace." So Amazon is deemed to be a marketplace facilitator for third-party FBA sales facilitated on Amazon.com.

Marketplace Facilitator Legislation

"Marketplace Facilitator legislation is a set of laws that shift the sales of tax collection and remittance obligations from a third-party seller to the marketplace facilitator." This legislation is the attempt by some of the states, to close the loophole Amazon takes advantage of, to not collect sales tax on the more than 50% of Amazon's total unit sales - stemming from third-party sellers.

As of 2018, Marketplace Facilitator legislation is currently in effect in the following states:

Since they already collect in those states, why doesn't Amazon just collect all third-party sales tax?

Competitive advantage

Some could argue that Amazon has built its empire in large part by leveraging tax advantages. These tax advantages, as the scale of Amazon's economic activity, is no small feat.

This is one of the ways by which Amazon has been able to keep its prices low, relative to brick-and-mortar retailers such as Walmart and Best Buy. Because of their physical presence, a brick-and-mortar retailer cannot avoid sales tax.

Furthermore, In a 2016 study, economists found that after the application of the Amazon tax - in states where they collected, online shoppers cut their spending on the site by 10 percent. This went up to 29.1 percent for items priced at $250 or more.

For example, if you were looking to buy a new Apple MacBook which retails for $1200 and you lived in California's 90210 zip code - sales tax rate of 9.0%, it would cost you $108 in just sales tax. Now compare that to purchasing from a seller who does not collect sales tax.

So why don't all states just pass Marketplace Facilitator legislation and make Amazon collect sales tax?

Politics

States have the power to adopt Marketplace Facilitatory legislation and place the administrative burden of sales tax compliance on Amazon, rather then small third-party sellers, but that's not in their direct interest. Instead, states and U.S. cities are outbidding each other to see who can give Amazon the biggest subsidies.

These politicians are after what comes with having an Amazon HQ or fulfillment centers in their jurisdictions, thousands of jobs and millions, if not billions, in economic activity. Their main goal is rather how much sales exemption and subsidies can I provide to Amazon, so they bring those jobs and I get re-elected; not how can help the small mom-and-pop business survive.

Cost of Sales Tax Compliance for FBA Sellers

As an Amazon FBA seller, you would most likely fall into two buckets. Some sellers will surrender to the states and start collecting sales tax - despite the burden, and others will take the wait-and-see approach. Although some sellers might not be happy with the choices they have, they do nonetheless have these choices.

My goal in this is to inform you of all your options, so you are not making your decision out of fear or lack of information. Let's now take a look at what it would truly cost an FBA seller to comply with sales tax across the states with FBA fulfillment centers. This is the part service providers often leave out.

For example, let's say you are a million-dollar FBA seller. Because you are concerned about the potential risk of states coming after you, you opt to register and collect sales tax in each state. After all, the sales tax is a tax on the consumer and you understandably would not like to pay out of pocket.

Here is the scary part. Let's be generous and put your profit margin on a million in sales at 21%. You would net $210,000 in profit and at face-value everything is peachy. But remember, you chose to register and collect in each state; so not only will you have to register for sales tax, but you also have to now register for income tax in those states.

Unlike sales tax, income tax cannot be streamlined because each individual's tax situation is different. You can't just hire a tax firm to automate the process by taking data from your Amazon dashboard. Not only will you have to register in all the states, but if you are an S-Corp, you have to file for the S-Corp and personally.

At the end of the day, it's not the sales tax that is expensive, where are you going to find an accountant who can do 50 states worth of income tax? There probably aren't many accountants who will charge you less than $1000 per return. When you factor in the cost of sales tax and income tax compliance, at even $500 per return, it's easily a 6-figure compliance cost. That's not even factoring in your time.

Furthermore, you have to register annually with the Secretary of State which comes with a calculated yearly cost of up to $10,000. Check out this list of annual fees to keep your LLC in compliance in each state.

Forget a small FBA seller, how is a million-dollar seller going to afford the cost of compliance? All their profits will be sucked up by accounting and compliance cost.

Here is another crazy situation FBA sellers could potentially end-up in if current laws don't change. If before Wayfair, states were already asserting nexus over you because of the physical presence of your inventory. Any state with an FBA warehouse will say you also have income tax nexus in that state.

The average price of an Amazon seller's product is $25. According to the economic threshold of 200 sales or $100,000, it only takes $5000 ($25 x 200) to trigger nexus in that state. This would mean you can have nexus in all 50 states and only be a $250,000 seller ($5,000 x 50). "This is insanity and why, according to Paul, this new law is unconstitutional."

FBA Sales Tax Amnesty Program

By now you've probably heard of the sales tax amnesty program by the Multistate Tax Commission. Let's examine what it is and its implications for your FBA business.

The MTC is a sort of trade organization, that represents the interest of tax departments and state taxing authorities but is not the government. Founded in 1967, MTC is designed to promote uniform tax law and compliance across the states.

The MTC was approached by some Amazon sellers organization, which gave them the impression that they were representing the entire Amazon community. They essentially said they were interested in their amnesty program because a lot of Amazon sellers were getting audited by states and those who were worried about being audited, would like to come forward and come clean.

The idea was to help Amazon FBA sellers become sales tax compliant, without facing fines and penalties they would otherwise face - due to failure to collect and remit past due sales tax.

This led the MTC to negotiate this amnesty program, with only a 60-day deadline. Paul points out many issues with the program.

- First, a 60-day deadline, for companies with no tax departments is unreasonable. "Not even GE or Walmart - with their huge tax departments, would put up with such short notice."

- Second, the program was negotiated on the assumption that nexus is the issue, not who is the retailer?

- Furthermore, the people behind the policy don't understand the facts about selling on Amazon. They perceive it as selling on craigslist or a flea market. Overlooking how little control FBA sellers have relative to Amazon.

Below is the list of states participating in Sales Tax Amnesty.

Source: Taxjar.com

Paul brings up another important consideration. The reason they were forgiving back taxes is that, in their mind, some sellers (FBA) had a physical presence already. So, if these states think you had nexus a year ago because of FBA inventory, then in a lot of these states where Amazon has fulfillment centers, "I'm not sure these economic nexus test even matter for you."

The states considering you as having nexus, because of your physical presence, would mean you don't get economic nexus consideration. So which one is it? "This raises a lot of unanswered questions."

Paul's personal opinion on the topic of the amnesty program is that "it's a bad policy and a path to major compliance burdens." Accepting the policy and implication of this program would mean FBA sellers could lose the opportunity to say "wait a minute, shouldn't this have been Amazon's burden?", as the law indicates.

If this is accepted as law, it would mean that small mom-and-pop stores would now have the same compliance burdens as Google or Walmart in regards to tax.

This means spending $30 per return, in every state, every month just to file their sales tax. Furthermore, they are now subject to income tax, franchise tax, and all these other taxes which could total $500-$1000 annually, per state.

All of a sudden, a small seller now has a compliance burden of $50,000 or $70,000 every year. This is the path MTC is leading FBA sellers down, "all because of bad policy and bad application of the law."

When Should Amazon FBA Sellers Collect Sales Tax?

We now know that businesses have to collect sales tax in states where they create nexus. We also know that nexus can be triggered by either a physical presence or economic nexus - post the Wayfair case. But because what determines nexus varies from state to state; it is important that you check the requirements in each state where you have activity.

Common Ways to Trigger Sales Tax Nexus:

- Location: Nexus can be triggered by your location or a physical presence. This can range from offices, warehouses, or stores.

- Personnel: An employee, contractor, and other persons doing work for you can trigger nexus. For example, if you reside in California, but you hire an uncle in Nebraska to help you take product photos. Because you operate from California and have an employee in Nebraska, you now have sales tax nexus in both states.

- Affiliates: Any person who advertises your products in exchange for a cut of the profits creates nexus according to many states.

- Inventory: Most of the states have ruled that inventory such as 3rd party fulfillment constitutes nexus. For example, if you store FBA inventory in a warehouse in Texas but live in Minnesota, you have sales tax nexus in both states.

- Economic: Post Wayfair, a seller can create nexus by either meeting a certain threshold in dollar amount ($100,000 in South Dakota) or having a certain number of sales transactions (200) in a state.

Below is an example of the conditions that trigger Nexus in the state of Kansas.

Source: Taxjar.com

Check out this list of Conditions that create sales tax nexus in each of the 50 States.

FBA Sellers and Inventory Nexus

The inventory sales tax nexus may be the most relevant form of nexus creating 'activity' to Amazon FBA sellers. For sellers looking to comply with sales tax laws, the easiest way to determine if you have nexus in a given state is to determine whether you have inventory in an FBA fulfillment center within that state.

Amazon does not always notify you before they move your inventory to new fulfillment centers. So, for larger FBA sellers, this might mean proactively registering in all the states with fulfillment centers. Smaller and midsized sellers can typically wait until they see sales from a particular fulfillment center before they register and charge in that state.

Source: Taxjar.com

Here's an updated list of all the states with an Amazon fulfillment center.

Paul, speaking as a tax expert, argues, that having inventory is not sufficient enough to create nexus for FBA sellers. However, from the state's perspective, they consider any online seller who uses the state's resources (roads for delivery, etc.) to have nexus. The point Paul wants to get across to you is that, by definition of law, this nexus creating activity is Amazon's doing and therefore responsibility, not the FBA sellers.

He points out, "the analogy that Amazon is just a mall when it comes to their marketplace is totally wrong. Amazon sellers are not the same as retailers at the mall." Amazon's terms and conditions contract, clearly point out that FBA sellers are not allowed to get their own client list.

When you go to the mall, you also don't pay the mall, you pay the store you're buying from. Furthermore, the mall is not going to seize inventory from the stores because of some issue, and force the store to refund consumers.

There are clear differences between malls, marketplaces, and Amazon; "that is indicative of the fact Amazon is a retailer, not just a marketplace." Because the states and MTC don't understand the facts," they've been operating on the false assumption that Amazon sellers are just in this sort of open marketplace, which is far from the reality."

How do I know where I have Inventory Nexus?

Not only does Amazon not notify you before they move your inventory, but they probably won't store your inventory in every state with an Amazon fulfillment center. So how do you find out where you have inventory?

You can pull your Inventory Event Detail Report directly from your Amazon Seller Central to help you determine where your inventory has been stored.

If you are looking for an easier way to automate this entire process, you can use TAXJAR. TaxJar's system shows a brown Amazon badge next to each state where your product ships from, making it easy to identify where Amazon FBA gives you sales tax nexus.

Source: Taxjar.com

FBA Sellers and Economic Nexus

Another major indicator, of when FBA sellers should collect sales tax is determining where you have economic nexus. Since the Wayfair ruling, we now know that meeting an economic threshold in a given state, can also cause FBA sellers to trigger nexus. The economic nexus rule is a continually moving target and FBA sellers should double-check with each state where they have activity.

Source: Taxjar.com

Understanding which states have enacted economic nexus standards, and how those standards are articulated in each state, is key to maintaining compliance in this confusing landscape regarding sales tax.

Many states have already articulated transactional thresholds that they deem to create "substantial nexus" with their state. While most have copied the South Dakota standard of $100,000 in sales and 200 transactions, it's not universal.

FBA sellers should check each state's economic nexus requirements to stay informed and up to date on the effective and pending legislation.

FBA Sellers and Taxability

Another important factor for FBA sellers is product taxability. Once you've determined that you have nexus, you have to determine if what you're selling is taxable. Most states tax all items of TPP or tangible personal property. TPP is defined as property that can be seen, touched, tasted and/or smelled. The majority of what is sold through FBA fits the definition of TPP and is going to be taxable to almost all of your customers.

Generally, tangible property is taxable while services are not. As with everything having to do with sales tax, this might differ across different states. Some common product categories like clothing and textbooks could not be taxed or taxed differently in some states. For example, Minnesota doesn't tax grocery or clothing but Tennessee taxes grocery items but does so at a reduced rate.

The good news is, once you are registered in a state you can have Amazon track the taxability and collect the right rates through their systems. The key is to match what you sell with the correct category.

If you have questions about your specific products, you can click on the specific state on the map below and double-check their tax guidelines.

Source: Taxjar.com

FBA Sellers and Materiality

After determining you have nexus in a given state, the next important factor to consider is 'materiality'. Before you panic and register in each state and start collecting sales tax, you should determine if the amount of tax you should be collecting is worth the effort and cost to your business.

For example, if your sales into a state for the previous year was only $200 then the amount of tax you would be roughly $16. In this case, it would not make business sense to get registered and spend more than you would if states came after you and charged you a penalty. How much could the penalty and interest on $16 be? Contrast that with the cost of registering, collecting and remitting sales tax.

However, you need to use your own judgment and keep an eye on your sales volume. What is material for one FBA seller may not be material for another, when it comes to materiality you don't want to get registered before you're ready, but you don't want to wait too long either.

In both instances, you could be costing yourself unnecessarily. Choosing the right time to get registered usually comes down to whether the costs of getting registered and filing are less than the costs associated with the state finding you.

Okay, I've triggered nexus now what? How do I collect FBA sales tax?

How to Collect FBA Sales Tax From Buyers

Once you've determined nexus, taxability, and materiality in a given state; you have to register for a sales tax permit and start collecting sales tax. Let's look at how exactly you go about doing that.

It's very important you register with a state before you start collecting sales tax. States consider it illegal to collect sales tax without a permit, no exceptions. Once you receive your permit, you will be assigned a sales tax filing frequency and sales tax due dates.

When it comes to collecting sales tax, luckily Amazon has a robust sales tax collection engine. You just have to make sure you to set it up. Amazon will collect the right rate and even determine whether a state is "origin-based" or "destination-based" or if a sales tax rate has changed. Amazon does charge 2.9% of each transaction in order to collect sales tax.

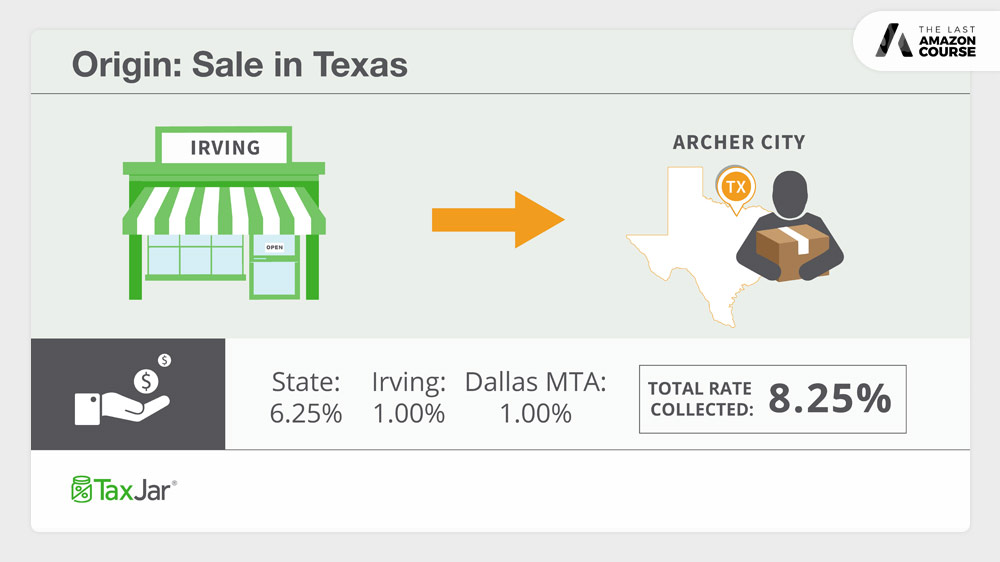

Origin vs. destination-based Sales Tax Examples

Source: Taxjar.com

If you live in Stamford, New York, since NY is a destination-based sales tax state, you would be required to collect sales tax at the rate of your buyer's address. As the example above illustrates, you operate your business in Stamford and sell to a buyer in Buffalo, therefore, you would be required to charge the seller 8.75% sales tax (state base rate + county rate).

Source: Taxjar.com

If you live or have nexus in Irving Texas and sell to a buyer in Archer City, as illustrated above. Because Texas is an origin-based sales tax state, you would charge any buyer at your home rate of 8.25% (state base + county + local).

Amazon charging you 2.9% might seem excessive but the alternative is even worse, you either don't collect sales tax or have to deal with complicated concepts such as origin-based and destination-based taxing jurisdiction as illustrated above.

You can check this list of origin-based and destination-based states for more clarification.

How to set up sales tax collection on Amazon FBA

- Login to your Seller Central account

- Click "Settings" then "Tax Settings" on the drop-down menu

- Chose the option: "View/Edit your Tax Collection & Handling & Giftwrap Tax Obligations Setting"

This is where you can choose which states you want to collect sales tax, as well as the county and other local levels. You will need your state sales tax registration number before Amazon allows you to set up sales tax collection. This is a safeguard to prevent sellers from unknowingly or unlawfully collecting sales tax without being registered.

Sales Tax Automation Solution

This can be an overwhelming process for FBA sellers, especially beginners, If you are looking for a sales tax collection solution that is easy and can be automated, TaxJar is a great option. Their program will connect with your account and provide you with a comprehensive report of all sales tax collected in each county, city and other taxing jurisdiction.

Source: Taxjar.com

What should Amazon FBA sellers take away from this?

Prior to the Wayfair case, the interpretation of sales tax was clear, if you didn't have a physical presence, you did not have nexus. Although the states main focus in the Wayfair case was primarily aimed at e-commerce giants such as Wayfair and Overstock, the states are still free to enforce these laws on any business.

As we noted, tax laws are a state matter not federal. The Wayfair case essentially allows the states economic nexus laws to stand - unless challenged.

Although inventory being considered nexus is relatively new, the reality for most of these states is they are broke. This means they will need more people, to pay the taxes for them to stay afloat. They are looking at every way possible, to use their laws to increase their taxpayer base.

In our case, they are simply easing the definition of nexus to include FBA sellers (as well as anyone else warehousing inventory); with no regard for the potential burdens, it might cause small and medium-size sellers on Amazon.

What you should take away from this post; there are just no clear answers right now and it can be scary. Paul's argument is not that taxes should not be paid, he's simply pointing out the reality for small sellers. Small and medium-size FBA sellers simply don't have the resources to comply under the current sales tax landscape.

Our goal with this post is to open your eyes to the reality and implications of FBA sales tax. It's just not as simple as most websites are making it out to be. There are a lot of legal problems at hand, regarding the FBA sales tax debate after the Wayfair ruling.

Over the last year, the states have ramped up their enforcement efforts with harassing letters, emails, and calls to small business online merchants; that go as far as threatening incarceration for the failure to comply with sales tax demands. These states are driving online merchants to their breaking point, pushing them to make drastic and unsound business decisions purely out of fear of the tax authorities.

If the current trend in FBA sales tax continues, it will likely put an end to the progress of small merchants everywhere, who can not afford the cost associated with compliance burdens. The Supreme Court case by Paul and OMG& is essentially asking the Court to not overlook " Quills emphasis on the compliance burden. Constitutional precedent requires that states cannot levy taxes on taxpayers, with utter disregard for the burden that such taxes impose on interstate commerce."

This why Paul and OMG are fighting to protect and give online merchants a voice in this debate. As an FBA seller, their fight is also your fight and you should join them in helping fight for the future of your Amazon FBA business.

Over 375+ videos (45+ hours)

Interviews with other million dollar sellers and CEO's, and much more