OFX Review: Low Fee International Currency Transfer

Are you looking for the best way to transfer currency internationally in 2020?

Regardless of the platform on which you are currently selling, you are most likely losing money to fees and unfavorable exchange rates.

In this article, we cover how you can safely and efficiently send money overseas with OFX International currency transfers and the lowest fees on the market.

Learn how you can strategically increase profits by up to 10% using OFX.

How OFX Can Benefit You

- There are no wire fees.

- USD to USD transfers are cheaper than banks

- Rates start at 1.5% and go down

- Instant USA bank accounts for international sellers.

- Send internationally in less than 2 minutes 24/7

- Money delivers in 24-48 hours even on weekends

The Last Amazon Course has partnered with OFX to save you time and money on your next international currency transfers.

Pick an OFX coupon below based on your level of sales volume per year and save money with the best-negotiated prices in the market.

** Please don't click on the wrong link, you will cost yourself and OFX time and lose out on the best rates.

What is OFX?

OFX is an online international currency transfer provider for eCommerce and Amazon sellers or anyone sending money across borders. With OFX anyone can use the OFX mobile app or online portal and send money to over 80 countries.

With no maximum transfer limit and a minimum of $1000, OFX is one of the cheapest international currency transfer service providers for your business.

Along with having one of the lowest exchange rates in the market, they are known for providing exceptional 24/7 customer service to their clients.

OFX does not impose transfer fees regardless of the amount you transfer.

Whether you're sending money to your supplier or for any reason abroad, OFX will save you money and time.

How can OFX benefit your business?

A lot of sellers, even advanced 7-figure sellers don’t often realize they are being charged a currency transfer rate when they transfer money from dollars to Euros or between other currencies.

When selling in international markets or for sellers located internationally and selling in the U.S., Amazon doesn’t tell you but you’re being charged around 3.5% - 4% on top of the selling fees.

With a solution like OFX available to you, using Amazon or a bank is a really inefficient way of doing business.

OFX rates start at 1.5% and go down as your volume increases. These rates are even lower with our negotiated deals.

OFX Transfer Fees Vs. Banks & Amazon

| Internation Transfer Rates | OFX | Banks | Amazon |

|---|---|---|---|

| Fees | As low as .5% | 3.5% - 4% | 3.5% |

| Transfer Times | 24-48 hours | 2-5 days | 3-5 days |

| OFX Wire Transfer | Banks | OFX |

|---|---|---|

| Transfer Time | 3-5 business days | 24-48 hours (even weekends) |

| Transfer Fees | $55 | $25 |

For sellers switching between currencies, not only is Amazon charging you but banks also charge margins.

For example, if you are in the U.K. but selling in the U.S. or vice versa, when paying suppliers in China you have convert currencies twice which ends up costing you around 7%.

You may not think 2% is not a big deal, but if you are running on a 20% margin in your business, 2% in fees ends up being 10% of your profit margin.

Here is a real-world example of the opportunity cost of losing just 2% of profits to fees.

| International Revenue | Monthly Revenue | 2% saving monthly | Annual Revenue | 2% saving annually | Revenue over 5 years | 2% saving over 5 years |

|---|---|---|---|---|---|---|

| Canada | $10,000 | $200 | $120,000 | $2,400 | $600,000 | $12,000 |

| U.K. | $50,000 | $1,000 | $600,000 | $12,000 | $3,000,000 | $60,000 |

| Germany | $100,000 | $2,000 | $1,200,000 | $24,000 | $6,000,000 | $120,000 |

| Australia | $500,000 | $10,000 | $6,000,000 | $120,000 | $30,000,000 | $600,000 |

These numbers are not revenue numbers but part of your profit. If you were to compound these numbers, the opportunity cost is even higher.

Instead of unnecessary fees, this money can go back into your business or launch another product on Amazon. OFX is a quick and simple process you can set up today and benefit from for years to come.

OFX Customer Reviews

How OFX Works

Using OFX is a simple process designed not only to save you money but also time. During the sign-up process, they will analyze how you're currently moving your money internationally and will let you know how much Amazon is charging you.

In about 10 minutes, they will figure out what you're doing, how you are doing it and show you where you can save money.

Check out this video explaining how traditional transfer wires work and exactly how OFX works to save you money on international currency transfers.

How to use OFX money transfer

- You sign up & lock-in your transfer rates. Tell your OFX representative how much you’re transferring.

- Send OFX your funds. They accept wire transfers from your bank account or you can apply to set up an ACH direct debit. Keep in mind, OFX doesn’t accept cash, credit cards, checks or bank drafts.

- OFX delivers your money to your recipient. Their transfer to most countries takes 1-2 business days. You can always track your transfers online or with the OFX mobile app.

Here is a walk-through of how to transfer currency on OFX

OFX Exchange Rates

Unlike your bank and other currency transfer services, OFX customers can transfer money internationally with zero OFX transfer fees.

International market exchange rates are always fluctuating on a daily basis and can be different every day. As a rule of thumb the larger the amount you send using OFX, the better your exchange will be.

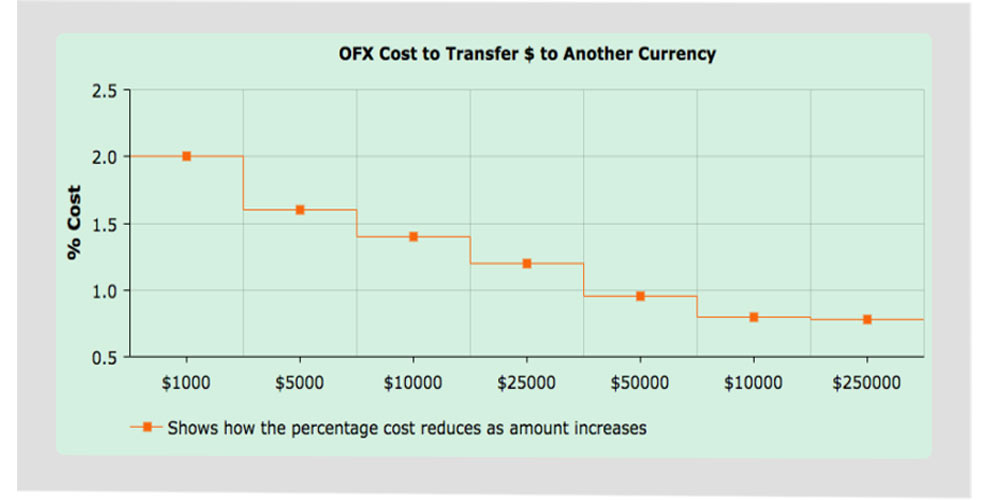

Here is an OFX cost to transfer graph that shows how the percentage of cost reduces as the amount you send increases.

In the above example, the graph outlines how the OFX cost to transfer to another currency starts at about 2% for $1000 and decreases to around 0.7% for transfers of $25,000.

With our negotiated discounts these rates are even much lower than outlined in the above example.

OFX Live Exchange Rate

Since the international currency exchange rates fluctuate constantly, OFX created a live exchange rate widget where you can check your rates at any time.

Whether you want to transfer euros to dollars or any other global currency, this is the place to check live and historical currency exchange rates

Types Of Exchange Rates

There are 3 major types of exchange rates that determine the market value of currencies.

Floating exchange rates

Most major global currencies including USD,GBP, and EUR use the floating exchange rate which is determined by supply and demand forces. This means the value of a given countries currency is determined by market forces such as interest rates, consumer and inflation data, and the fluctuations in key exports.

Managed float exchange rates

Countries like Indonesia and Singapore use this exchange rate system. The central bank, unlike market forces, will intervene in the market to control the currency value.

Fixed exchange rate

Currencies using this system to determine the value of currencies tie the value of their currency to fluctuations of another currency. For example, the Hong Kong dollar and the U.A.E. Dirahm are pegged to the U.S. dollar.

OFX Forward Contracts

A Forward Contract is an arrangement that allows you to transfer money at some time (up to 12 months) in the future at an exchange rate that you agree to now. With forward contracts, you know what the exchange rate will be at the time the transaction takes place.

Forward contracts allow you to avoid the risks and uncertainties associated with adverse exchange rate movements.

Currencies on average fluctuate up and down about 10% in a given year. For sellers who are doing high volumes, this directly impacts profits in a major way. Paying close attention to these fluctuations can allow sellers to hedge against potential downsides by used forward contracts and locking in favorable rates.

Forward Contract Pros

- Forward Contracts are beneficial for sellers if exchange rates are particularly attractive now, and you want to lock in that rate to hedge against uncertainty in the future. This can be especially helpful for small businesses that want to keep their cash flows predictable when buying or selling overseas.

Forward Contract Cons

- Forward Contract prevents you from taking advantage of beneficial movements if your currency pair continues to move in a profitable way. To avoid missing out on further profitable movements, sellers can use a Forward Contract for a smaller portion of their total payment (maybe 50%) as a way to hedge against volatility.

Learn how to protect your profits from abroad with international currency hedging

For advanced Amazon sellers, watch a detailed walk-through from The Last Amazon Course on how to hedge international currencies and leverage currency fluctuations.

Open an international bank account with OFX for FREE

International bank accounts are an absolute necessity in order to avoid unnecessary fees.

OFX is the easiest option for creating an international bank account. Creating your account only takes 30 minutes of paperwork, a week or two to get you through compliance and you will be good to go.

OFX transfers over $21 billion annually and will help you keep more profits in your pocket by saving you money during this process.

Here is why you need an international bank account

For example, if you are an Amazon seller in the U.K. but selling in the U.S. Amazon will send U.S. dollars to your U.K. bank account. Your bank account will charge you around 3.5% - 4% for converting the USD into U.K. Pounds.

If you have an OFX international bank account as a U.K. citizen you can receive your money in U.S. dollars and only pay about 1% or even less with our negotiated deals with OFX.

When it’s time to pay your suppliers in China or where ever you happen to be sourcing from, you directly pay them with USD from your OFX international bank account.

If you are using a U.K. bank account, this means, not only is your bank charging you 3.5% when transferring your Amazon payment from USD into British Pounds but because suppliers want dollars as well, your bank will charge you another 3.5% when you transfer and wire payments to your suppliers in China.

Anyone selling on Amazon from outside the U.S. or selling internationally from the U.S. in 2020 must get an international bank account.

How to open an international bank account for Amazon FBA

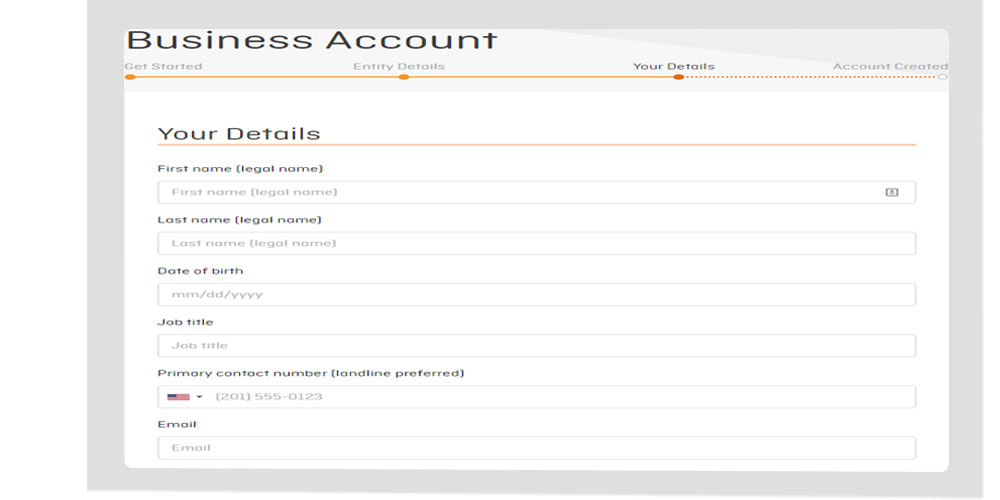

The sign-up process with OFX for an international bank account is really easy and be completed in a few simple steps.

Step 1: Use the right OFX coupon link below based on your seller level. Please make sure to use the right link as it will make your process a lot easier.

Step 2: Pick the account type you want to register for, personal or business.

Step 3: Choose your country and business entity type.

Step 4: Fill out your business information.

Step 5: Fill out your personal details. Make sure to use a correct phone number as OFX will contact you to verify and help you through the process.

Submit your application and you are all set to go.

Amazon Bank Account Myth

Some people are under the impression that Amazon will suspend your account for changing your bank account, this is not true at all. Changing your bank account from your current one to OFX will have no impact on your account.

However, make sure to not change your account the day of or the day right before Amazon sends out payments. This could potentially delay your funds and complicate the process.

OFX vs. Transferwise

| OFX vs. Transferwise | Delivery Methods | Minimum Transfers | Transfer Speed | Currencies | Transfer Fees |

|---|---|---|---|---|---|

| OFX | Bank Transfer | $1,000 | 24-48 Hours | 55 currencies | $0 |

| Transferwise | Bank Account | $1 | 1-4 Days | 40 currencies | % of the total |

TransferWise fees are based on a percentage of the total amount you are sending. As a result, TransferWise is a best for situations when sending a low amount of money across borders.

We recommend using OFX when you need to send a relatively larger amount of funds to suppliers or across borders.

Here is how TransferWise fees compare to U.S. banks

OFX vs. Xoom

Here is how OFX compares with Xoom web-based money transfers.

| OFX vs. Xoom | Delivery Methods | Minimum Transfers | Transfer Speed | Currencies | Transfer Fees |

|---|---|---|---|---|---|

| OFX | Bank Transfer | $1,000 | 24-48 Hours | 55 currencies | $0 |

| Xoom | Bank, Debit, Credit | $10 | 1-3 Days | 15+ | $4.955 bank / $10.99 debit or credit |

OFX vs. WorldFirst

Here is how OFX compares with WorldFirst international money transfer service.

| OFX vs. WorldFirst | Delivery Methods | Minimum Transfers | Transfer Speed | Currencies | Transfer Fees |

|---|---|---|---|---|---|

| OFX | Bank Transfer | $1,000 | 24-48 Hours | 55 currencies | $0 |

| WorldFirst | EFT or Direct Debit | $1,200 | 1-2 Days | 33 | $0 |

Save money and securly send transfers with OFX around the world

Take advantage of the promo codes from The Last Amazon Course and get the lowest OFX transfer rates anywhere on the market.

OFX FAQ's

What information is required for registration?

To register, you will need your full name, DOB, address, occupation, email and contact number.

How long does registration take?

The registration process takes no more than 10 minutes and we can verify your identity electronically and swiftly. On occasion, we may require some additional documentation from you, but we’ll walk you through exactly what that might be.

What banking information does OFX need?

We will require the bank account information of your recipient in order to successfully make a transfer and this information will vary depending on the country you are sending to.

How long do online payments take?

Wire transfers are easy, fast, and reliable ways to send money both domestically and internationally. Payments to major markets can usually be made within 1-2 business days from the time OFX receives your funds.

What are my transfer options with OFX?

If you want to make a one-off money transfer, our single transfer may be for you. If you’d like to make multiple transfers, perhaps for regular mortgage or business payments overseas, our recurring transfers will allow you to set up an automated transfer schedule.

What recipient information does OFX require?

The information we need will depend on the currency and country we are sending to. Our very intuitive, online form will ask for the correct information depending on currency and country and will let you know if it’s not the right amount of numbers or characters.

Over 375+ videos (45+ hours)

Interviews with other million dollar sellers and CEO's, and much more